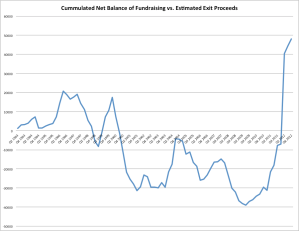

In the last several days I spent some time analyzing the VC money flow. I didn’t want to get lost too much in the weeds so I just looked at the capital Limited Partners are committing to VCs and on the exit proceeds generated via M&As and IPOs. As written earlier, we saw in the last couple of years a positive net balance of Cash flowing into the VC sector in terms of LP commitments and Cash flowing out in terms of estimated VC exit proceeds. This time I took this approach a bit further and looked at the last 20 years and calculated a cumulated net balance since 1993.

And voila, after the Cumulated Net Balance went negative in late 2000 and never saw positive territory since, the picture changed dramatically in 2012. Just to be clear on the math, you have two main input parameters: the LP commitments into VC funds and the share of the VCs on the exit proceeds. The first is relatively easy to measure for the later you have to subtract proceeds to founders, option holders, Angels and Strategic Investors from the Exit data.

The very first comment that might come to mind looking at the chart is that obviously Facebook had a major impact, so I did a second calculation without the Facebook IPO. And surprise it still is positive! It was about 15 months ago when I wrote in a Silicon Valley Bank White Pape that the so called “lost decade” is not lost at all and that we should expect great returns of most of these vintage years with the exception of the 2000-2003 period.

Finally we reached the point VCs generating more cash-flow (with and with out Facebook) than it consumes – the “Lost Decade” can be declared dead!

What contributed to this? It is a combination of two factors: a) great entrepreneurship that lead to a significant inventory of great tech companies and b) discipline on the side of Limited Partners not to over-finance the sector (as painful as it might feel for many VCs). Just one note on the later: if LPs would have been a bit more disciplined in 2004-2007 the net balance could have easily been positive in that period.